Risk Register

Macclesfield Town Council Risk Register – Approved at Full Council 25th March 2024

The risk register is broken down into the following categories:

- Employees

- Finances

- Insurance and Security

- IT

- Legal

- Property

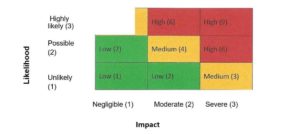

The matrix below is used to give a score to each risk. This document is reviewed annually at a minimum.

Employees

|

Risk No. |

Description |

Impact |

Likelihood Score | Impact Score | Risk Rating |

Control |

Review Date and Response |

| 1 | Provision of a safe and

fulfilling working environment for staff |

Unsafe or unhealthy working environment will have an impact on staff and their ability to work constructively and positively | 1 | 3 | 3 | H & S risk assessment and policy to keep safe. H and S briefings annually. Covid risk assessment in place and updated with changes.

Code of conduct in place for staff and councillors and regular team meetings and appraisals. Staff can work flexibly and from home in consultation with their line manager. Weekly team meetings in place. One staff member is trained in Mental Health in the workplace.

|

H & S risk assessment updated annually (or as need arises)

H & S policy updated annually. Appraisals completed annually.

|

| 2 | Employees contravene H & S Regs | Results could be an accident, affecting staff and services | 1 | 3 | 3 | H & S, insurance, Risk Assessments regularly

checked and updated, Personnel Committee meetings and staff briefings and training. |

As above |

| 3 | Potential legal proceedings up to corporate manslaughter | Accidents and reputational damage. | 1 | 3 | 3 | Employers Liability insurance Employee training and awareness

Solicitor services agreed at annual meeting, as are outsourced HR services. Each event held by MTC has its own risk assessment and equality impact assessment. |

Insurance and policies updated annually. |

| 4 | Staff retention issues | Impact on staff mental health and on delivery of projects, services and running of the council. | 1 | 3 | 3 | Staff training where appropriate, regular staff meetings. Staff receive informal regular positive feedback and also formal appraisals.

Staff are supported by Town Clerk, Chair of Personnel, Mayor and Chair of all Committees. Commitment to staff wellbeing – Town Clerk ensures an open approach to discussing any issues that arise and solving them. Staff have been encouraged to purchase equipment they need to effectively work from home. |

Ongoing |

| 5 | Insufficient staff or other resources to deliver the service

needs |

Slower completion of tasks and hold up in projects and services | 1 | 3 | 3 | Staff have good awareness of other team members’ essential tasks and can provide cover when required. Team meets weekly to keep each other updated.

Town Clerk to formally monitor and review staff and work levels. Any concerns regarding this to then be brought to Personnel Committee. |

Weekly team meetings incorporated |

| 6 | Compensation claim from employee for contractual

employment defects (including statutory failure)

|

Reputational damage for Council | 1 | 3 | 3 | Contract of Employment in place (modelled on NALC contract) updated Oct 2020.

Matters relating to staff discussed In confidence and at personnel committee where press and public are excluded. Town Clerk to keep up to date with employment law and seek HR advice where appropriate.

Supported and underwritten by Wirehouse Employer Services |

Ongoing support from Wirehouse. |

| 7 | Loss of services of employee | Impact on delivery of services and projects and smooth running of the council | 2 | 3 | 6 | By distributing knowledge and roles ensure, so far as reasonably practical, that loss of any one employee does not cause unrecoverable damage to business.

Robust recruitment process in place. |

Weekly team meetings, training and development policy. |

| 8 | Loss of key staff trained in financial systems, process or

rules |

Inability to pay suppliers in a timely fashion, which could affect projects and services. Implications for internal audit and AGAR.

Lack of accurate reports for the Finance Committee and Council. |

1 | 3 | 3 | Staffing arranged so that knowledge is distributed between RFO

and at least one other staff. Admin and Governance Manager can carry out the day to day payments and accounts if necessary. |

External Accountancy support in place. |

Finances and Financial Administration

|

Risk No. |

Description |

Impact |

Likelihood Score | Impact Score | Risk Rating |

Control |

Review Date and Response |

| 1 | To maintain financial records

that are correct and comply with all recommended accounting practice |

Adverse audit reports, legal action and loss of confidence

in Town Council |

1 | 3 | 3 | Clerk keeps up to date with legislative changes, discusses latest requirements with internal and external auditors

Member of Chalc which send regular briefings. Internal auditor reviews record keeping annually Advice taken from internal auditor, external auditor, accountant, SLCC + NALC on changes in regulation

|

Internal audit review recommendations actioned |

| 2 | Records non-compliant or inadequate | Adverse audit reports, legal action and loss of confidence

in Town Council |

1 | 3 | 3 | Internal Audit reviews record keeping annually and is on hand to advise on request.

Also advice can be garnered from External Auditor, independent accountant, CHALC, SLCC and NALC on changes and best practice. |

|

| 3 | To have a clear procedure for authorisation of payments. | Loss of income through error or fraud | 1 | 3 | 3 | Fidelity Guarantee Insurance

Town Clerk continually review controls and current procedures. Checks are in place to minimise this risk. 2 Councillors must authorise all payments and sign cheques and 2nd authorise the online banking account.

Debit cards are issued to staff and authorisation procedure is in place. |

Online Banking procedure.

Debit card procedure and policy. |

| 4 | Inappropriate expenditure made | Loss of income | 1 | 3 | 3 | Procedure and controls in place to minimise this risk of inappropriate expenditure. Payments made on the production of a VAT invoices. Payments have to be authorised by 2 Councillors and reported to Finance committee for review and corrective action if necessary

Staff must follow the Debit card policy and procedure. |

Debit card procedure and policy. |

| 5 | Invoice Payment without authority | Loss of income, fraudulent activity, reputational damage to the Council | 1 | 3 | 3 | All payments reviewed by clerk and reviewed by 2 Councillors before payment is made.

Cheques must be signed by 2 Councillors who are signatories

Online bank payments must be 2nd authorised by a Councillor who is a signatory. |

|

| 6 | Incoming Cash and cheque misappropriation | Loss of income, fraudulent activity, reputational damage to the Council | 1 | 3 | 3 | Receipts issued for cash payments and for cheque payments on request | |

| 7 | Theft of Funds | Loss of income, fraudulent activity, reputational damage to the Council | 1 | 3 | 3 | Bank statements reconciled monthly.

Fidelity Insurance in place against theft of funds by staff, Councillors and other persons

Incoming cash and cheques stored securely and banked promptly. |

|

| 8 | Financial Regulations become out of date with change in

technology, regulation or business |

Not following legal requirements – leading to reputational damage, | 1 | 3 | 3 | Council to review financial regulations once a year

The RFO and Clerk react to any changes in legislation or other areas in order to ensure the regulations are fully compliant and also provide a strong framework compatible with Council`s practices |

Financial Regulations reviewed annually |

| 9 | Lack of budgetary overview/overspend against budget

|

Council not aware of financial situation and therefore not prepared to make decisions. | 1 | 3 | 3 | Monthly review of income and expenditure by Clerk

Seven week review by Finance Committee

Quarterly review of nominal ledger

Access to online banking means Clerk can have realtime updates on payments and balance of bank account.

|

Finance committee meetings |

| 10 | Lack of finance to meet unbudgeted, urgent commitments ( with safety or other critical implications) | Inability to make urgent unbudgeted payments | 1 | 3 | 3 | Contingency included in budget

Reserves equivalent to at least 2 months spend available |

|

| 11 | Risk of fraudulent VAT numbers from new suppliers | Risk of claiming back VAT inappropriately | 1 | 3 | 3 | VAT numbers for all new suppliers with an expected supplies/services value of £1,000 or more in a financial year will be checked with HMRC register | Ongoing |

| 12 | Accounts

The RBS Omega accounts system is used which is an accepted accounts package |

Skills to use the software and produce accurate results. | 1 | 1 | 1 | A back up is also made at the end of each day held in the cloud.

Hard copies linked to council reports are held on file together with bank reconciliation reports, invoices/receipts/payments and cheques issued

Documents are retained for 12 years |

|

| 13 | Vat

The RBS Omega system incorporates a Vat schedule which is an accepted package which allows differentiation between tax rates etc. which is itemised in a full report relating back to the original item within the accounts |

Must ensure VAT claimed correctly in order to avoid paying back misappropriated funds and avoid reputational damage.

|

1 | 3 | 3 | Vat is applied to all mileage payments at the rate applicable at the time as advise by HMRC

Vat returns are lodged on a annual basis in line with accepted procedures

Clerk checks new suppliers VAT numbers on the HMRC register Procedures will be provided to HMRC every three/four years for comments and approval |

|

| 14 | Bank Arrangements

|

Barclays Bank is used and Public Sector Deposit Fund

Soldo account is used as a prepaid debit card solution for staff.

|

1 | 3 | 3 | One bank account used on a daily basis

Reserves are kept in Public Sector Deposit Fund, there is a small risk as the purchase of PSDF shares is not the same as making a deposit with a bank or other deposit taking body and is not a guaranteed investment. Although it is intended to maintain a stable net asset value per share, there can be no assurance that it will be maintained. Not withstanding the policy of investing in short-term instruments, the value of the PSDF may also be affected by fluctuations in interest rates. The PSDF does not rely on external support for guaranteeing the liquidity of the fund or stabilising the net asset value per share. The risk of loss of principal is borne by the shareholder.

|

Debit card procedure and policy. |

| 15 | Payments to Suppliers | 1 | 3 | 3 | All invoices are checked by the Clerk in advance of

payment and if related to an order, this has passed through the ordering procedure.

Each cheque from the main account must be signed by 2 Councillors as detailed on the bank mandates (which are amended when required to ensure that sufficient signatories are available at all times) online payments are authorised by 2 Councillors before the clerk pays them online – a Councillor must 2nd authorise them |

||

| 16 | Standing Orders and Direct Debits | Ensure they are correct, and the services are still necessary. | 1 | 3 | 3 | Standing orders, direct debits are presented to the Finance Committee on an annual basis.

Clerk reviews every month to ensure they are correct and filed appropriately. |

|

| 17 | Transfers | Transfers between bank accounts. | 1 | 3 | 3 | Monies may be transferred between the Councils accounts by the Clerk and authorised by 2 Councillors. | |

| 18 | Non-Compliance with statutory deadlines for the completion/approval/submission and other financial returns | Reputational damage to the Council | 1 | 3 | 3 | Programme of meetings set annually to ensure deadlines are met | |

| 19 | Bank Reconciliation | Bank reconciliations ensure that there are no issues with fraud or bank mistakes. | 1 | 2 | 2 | All accounts are reconciled using the RBS Omega system within

5 days of receipt of any statement

Reconciliation is checked by an independent accountant as employed by the council, every month.

Any discrepancies are immediately reported to the bank for investigation

Clerk monitors payments on Soldo account (for pre paid debit cards) and this is reconciled and payments recorded.

|

Debit card procedure and policy. |

| 20 | Access to the main bank accounts | Access is restricted however if unauthorised access took place it could result in fraud and loss of finances | 1 | 3 | 3 | As detailed under Banking arrangements & Procedures above,

no one person has access to monies held in the main accounts |

|

| 21 | Hire Charges | For equipment or rooms etc | 1 | 1 | 1 | Council agree the charges

The office must abide by these rates and any requests for preferential rates must be made by the hirer to Council for their approval

All bookings must be paid for in advance to avoid bad debts other block bookers are invoiced or given the option of paying the sites on a weekly basis |

|

| 22 | Cash collected for allotment rents and community events | Ensuring cash collected is banked and correctly | 1 | 2 | 2 |

At the office the cash is emptied and counted manually within one working day by at least two members of staff All cash collected at events is collected by appointed staff and a receipt is always issued (eg markets income)

|

|

| 23 | Petty Cash | N/A | N/A | No petty cash in operation | |||

| 24 | Processing and banking | Inaccurate processing and banking could lead to inaccurate financial reports | 1 | 2 | 2 | When the money is received it is balanced within the office

against any receipts/invoices and any discrepancies are followed up

When the monies have been balanced, it is input onto the RBS Omega system and all entry references are printed out and retained

A unique pay in reference is applied to each batch of banking which is loaded onto the RBS Omega system which is then checked against the bank reconciliation

|

|

| 25 | Expenditure/income coded incorrectly | Inaccurate financial reports | 1 | 3 | 3 | Town Clerk checks nominal ledger every quarter

Items are coded |

|

| 26 | Incorrect entries by bank | Loss of income – inaccurate financial reports. | 1 | 3 | 3 | Bank statements reconciled monthly

Any issues are immediately investigated by the Clerk |

Reviewed monthly |

| 27 | Annual Audit | Important to ensure the council is managing finances in accordance with regulations.

Issues within the AGAR could affect Council negatively, loss of trust and reputational damage. |

1 | 3 | 3 | The annual auditor is appointed and directs the format and

structure of the audit in line with current legislation and requirements

Audit costs and levels of requirement are determined by government legislation based upon the annual income or expenditure levels

The Town Clerk completes the year end accounts to audit trial level and prepares any additional reports required by the external auditor

The Town Clerk presents the completed Annual Return, Financial Statement and other documentation required to Council in line with the timescales provided by the external auditor

Once these have been formally adopted and signed by Council, they are lodged with external auditors

Any queries raised by the auditors are dealt with by the Town Clerk in the first instance

Final sign-off by the external auditor is presented to Council |

|

| 28 | Annual Budget & Precept

Calculations |

Budget and precept calculations should be careful and considered as it sets the level paid by residents within the council tax.

|

1 | 3 | 3 | The annual budget and precept calculations are initially

calculated in October/November based upon the performance of the prior year and incorporating projected requirements which have been lodged by the office and council members

The Town Clerk also completes a mid-year review in October for the current year to calculate possible year end surpluses which may be incorporated within the future budget. The actual precept level is then calculated from the balance sheet assuming that the remainder of the current year’s budget will be utilised in order to estimate the year end bank balance

The new budgeted income, expenditure and reserves are then set against this balance in order to calculate a budget shortfall on which the future precept is based

The new budget is discussed and fine-tuned through the October, November and December Council and Committee meetings after the up to date number of band D properties have been confirmed by CEC discuss & amend any highlighted budget levels in order to best achieve, an acceptable precept level

Comprehensive minutes are recorded at each stage to substantiate the budget development |

Budget v actual reviewed monthly by clerk, 7 weekly at Finance Committee meetings.

Budget set annually. |

|

29 |

Internal Audit | Internal audit to ensure compliance and effectiveness of financial controls and managing funding effectively. | 1 | 3 | 3 | The Internal Auditor is approved annually by Council at the AGM and completed an annual internal audit and end of year audit as part of the AGAR.

|

|

| 30 | Setting and Monitoring of Budgets | Setting a comprehensive budget and monitoring of budgets to ensure accurate information to make sound financial decisions | 1 | 3 | 3 | The final budget is approved in December /January and CEC is immediately advised of the precept

On-going daily expenditures have already been incorporated within the budget and the RFO monitors invoices etc. against the budget schedule to confirm that they are within the limits

All orders are checked against the accounts system to verify expenditure within the account code to date and the remaining budget

Any over expenditure is highlighted and brought to the attention of the Clerk

A full report of expenditures against budget is lodged with council at each Finance Committee Meeting.

This incorporates a print out of the income and expenditure against each annual budget and the cashbook extract

Any that do not meet the budget levels are highlighted by member if needed along with committed expenditure |

Budget monitored by Clerk monthly and finance committee every 7 weeks. |

| 31 | Supplier Procurement

. |

Ensure due diligence when selecting suppliers to insure VAT is correctly reimbursed and combat fraud | 1 | 3 | 3 | Check the VAT number of new suppliers who are registered for VAT to ensure against fraud.

Due diligence completed during the procurement of contracts process.

Insurance and liability is included in the procurement process. |

|

| 32 | Reporting | Ensure due diligence and accurate information is provided to the Council and to meet transparency requirements | 1 | 3 | 3 | Reports provided to each Finance Committee are:

• Receipts and Payments • Bank Reconciliation • Income and Expenditure • Authorised Payments

Potential under or overspend is discussed at Committee and Full Council meetings.

Local Government Transparency is adhered to: · Expenditure over £500 (every quarter) · AGAR and Audits · ITT and opportunities to quote · Information about Counter Fraud (annually)

|

Every Finance Committee Meeting (approx. every 7 weeks) |

Insurance and Security

|

Risk No. |

Description |

Impact |

Likelihood Score | Impact Score | Risk Rating |

Control |

Review Date and Response |

| 1 | Insurable risks | In appropriate levels of insurance to cover risk, leave council uninsured | 1 | 3 | 3 | Public Liability limit of cover £12,000,000

Employers Liability Limit of cover £10,000,000

|

Insurance reviewed annually

|

| 2 | Theft of money by employee or member | Loss of finances for council and negative reputational damage | 1 | 3 | 3 | Fidelity Insurance in place of £2,000,000

Financial Controls in place ( see finance section) |

Insurance reviewed annually

Financial controls reviewed within this document annually.

|

| 3 | Council owned building and allotments | Inappropriate insurance is a risk to the property. | 2 | 2 | 4 | Cover for buildings & contents

|

Reviewed annually. |

| 4 | Officials Indemnity | Covered to project officials | 2 | 2 | 4 | Cover of £250,000 | Limit £250,000 |

| 5 | Libel and Slander | Reputational damage to council | 2 | 2 | 4 | Cover £250,000 | Limit £250,000 |

| 6 | Personal Accident | Insurance for staff | 1 | 3 | 3 | Insurance covers

H & S risk assessment, policy and risk assessment for every MTC event |

Limit £2,000,000 |

| 7 | Legal disputes | Ability to ensure council follows all legalities | 1 | 3 | 3 | Cover for specified legal disputes | Limit £100,000 |

| 8

|

Insurance Provider | Must be a reputable provider | 1 | 3 | 3 | 3 Quotes sought in March 2021, Zurich are providing insurance for the next 3 years. | Insurance details reviewed annually and 3 quotes will be sought in 2024 |

| 9 | Business Interruption | Inability to deliver services and projects for residents | 1 | 3 | 3 | Potential alternative premises, IT back-up off site and ability to restore onto hired equipment etc

Cover in place for excess costs Working from home is viable |

Limit of cover £50,000 |

| 10 | Office security | Impact of staff safety, and all data and information. | 1 | 3 | 3 | MTC staff work in Macclesfield Town Hall which has door security.

Data and information is all backed up in the cloud. Secure documents are kept in lockable files Key press in situ with code. Lone work and H&S policy in place. Office is alarmed – CEC hold contract.

|

H&S policy and risk assessment reviewed annually |

IT

|

Risk No. |

Description |

Impact |

Likelihood Score | Impact Score | Risk Rating |

Control |

Review Date and Response |

| 1 | IT Security, safety of information/risk of loss of data | Data breach could cause reputational damage to the council and break data protection laws | 1 | 3 | 3 | Microsoft Office 365 installed on all PCs

Allows for cloud back up of information

Allows for cloud storage of all council data – more secure than onsite storage.

We use office 365 with sharepoint (a cloud based system) which facilitates off site/remote working.

|

As of October 2018. Also supports compliant Data protection 2018 legalities and operation and Cyber Security Training has been incorporated since 2020. |

| 2 | Loss of internet service | Inability to complete work and communicate, particularly during Covid pandemic. | 2 | 3 | 6 | Internet with reputable provider provided by CEC, Data allowance on mobile phone in emergency. | |

| 3 | Equipment failure | Unable to complete tasks | 1 | 3 | 3 | Budgeted annual amount for IT proposes.

To monitor photocopier contract and look to other ways to print documents. |

|

| 4 | Staff untrained for new software | Unable to complete tasks or tasks are completed inaccurately | 1 | 3 | 3 | Robust training and development policy with a training budget set aside annually. |

Legal

|

Risk No. |

Description |

Impact |

Likelihood Score | Impact Score | Risk Rating |

Control |

Review Date and Response |

| 1 | To ensure that all actions

taken by the Town Council comply with all current Legislation |

Non-compliance with legislation or practice Council being

‘Ultra Vires’

|

1 | 3 | 3 | Town Clerk to keep up to date with changes in legislation, seek

advice from SLCC, ChALC, NALC and others as necessary The Clerk reacts to any changes in legislation, requests from Town Council or other areas in order to ensure the regulations are fully compliant and also provide a strong framework compatible with Council practices Solicitor services on retention as are HR consultants, Internal auditor and accountancy support all agreed by Full Council annually.

Governance documents, polices and procedures are periodically reviewed with each full council meeting having an agenda item entitled governance review.

Annually the following are reviewed: The Standing Orders The Corporate Risk Register

Town Clerk currently completing CILCA

|

|

| 2 | Non-compliance with statutory deadlines for the

completion/approval/submission of accounts and other financial returns |

1 | 3 | 3 | Programme of meetings to meet statutory deadlines | ||

| 3 | Loss of documentation | 1 | 3 | 3 | Deeds and other legal documents relating to real estate stored

in the office |

Property

|

Risk No. |

Description |

Impact |

Likelihood Score | Impact Score | Risk Rating |

Control |

Review Date and Response |

| 1 | Allotments MTC owns however many are managed by Independent Allotment Associations | Need to ensure they are safe and fit for purpose and allow as many residents as possible to enjoy them | 2 | 2 | 4 | Allotments are insured. Several allotments are maintained by their own allotment association.

The Town council inspects allotments to ensure they are being used appropriately.

Policy is updated periodically – recently updated at Full Council 6th December 2021

Town Council will fund unsafe trees to insure health and safety.

|

Ongoing communication with allotment associations.

Allotments managed by MTC are subject to inspections by MTC Officers.

|

| 2 | Weston Community Centre owned by MTC with long term tenants | Tenants may not look after building.

Tenants may decide to end lease. |

2 | 2 | 4 | Lease is a full repair lease, the tenants must produce a risk assessment and a fire risk assessment and other safety checks.

Clerk visits the property to ensure it is well maintained. Insurance covers the structure of the building.

If tenants leave, new tenants would be sought. |

Reviewed annually |

| 3 | Taking Care of assets. | Assets could be stolen of misplaced. Insurance may not be of appropriate value. | 1 | 3 | 3 | An asset list is maintained by the Town Council Office on RBS SIgma

This is updated throughout the year from new assets which are in addition, a schedule of road furniture/bins/dog bins/bus shelters play area equipment etc., will be kept on a secondary list

The asset list is circulated to staff on an annual basis to ensure that all items are correct Assets are kept in an alarmed building with security. |

2023 a review of all assets is to be arranged to insure the Council has the appropriate level of insurance. |

| 4 | Taking over assets from CEC- currently South Park Pavilion.

(Also see next section) |

This project will cost a significant amount of money and expertise. | 2 | 3 | 6 | Due diligence to be undertaken prior to the transfer of any assets.

Heads of Terms agreed, the lease will not be signed until

a.) Planning Permission for the new building is granted b.) Finances have been secured

Business plan to be updated with updated costs.

Reserves to be used, however important to ensure reserves do not go below the threshold, therefore external funding may be necessary.

|

MTC have set up a South Park Pavilion Working Party to guide the building design and the public consultation.

Assistance from Chalc, CEC and experts in the area of building and procurement on this scale will be sought. |

| Taking over services previously managed by Cheshire East Council – currently the Visitor Information Centre | Opportunity to improve the existing service, however there will be significant impact including managing a new service, Tupe or taking on more staff to manage. Plus significant changes to our accountancy practices as we will be increasing income.

There will be a need to become VAT registered. |

2 | 2 | 4 | Due Diligence to be undertaken (including TUPE, Rent, current accounts) and a clear plan presented to full Council by Dec 2022 before a decision can be approved.

Working party set up for this project. |

Working party to start to work on the due diligence 2022. |